Getting TO80

Meeting Ontario's emission targets

The Economic Impact of Electric Vehicle Adoption in Ontario

Full Report

September 2014

Download Full Report or Report Summary in PDF format

Study Authors

- Brent Kopperson

- Executive Director, Windfall Centre

- Dr. Atif Kubursi

- Lead Economist, Econometric Research Ltd

- Andrew J Livingstone

- Freelance Journalist

- Ali Nadeem

- Lead Researcher, Windfall Centre

- Jen Slykhuis

- Program Manager and Research Assistant, Windfall Centre

©2014 Windfall Ecology Centre. All rights reserved. Permission is granted to reproduce all or part of this publication for non-commercial purposes, as long as you cite the source.

PDF copies of this publication may be downloaded from the Windfall Ecology Centre website: www.windfallcentre.ca/drive-electric/studies/ev-adoption/report/

This project was funded in part by the Ministry of Training Colleges and Universities and the World Wildlife Fund. The views expressed in this report are the views of Windfall Ecology Centre and do not necessarily reflect those of the Ministry or WWF.

About Windfall Centre

Created in 1998 by Brent R. Kopperson, Windfall Ecology Centre is a non-profit social enterprise dedicated to building sustainable communities. The creation of Windfall was inspired by a vision of healthy communities, where economic, social, and environmental needs achieve balance through social innovation, community partnership, and community action. The Centre's activities focus on re-powering communities to create lasting wealth in a carbon constrained 21st century.

Working at the nexus of energy, water, food, and people, we research, design, and deliver innovative climate change solutions. Our record of accomplishment includes achievements in public policy, residential energy conservation, renewable energy, electric mobility, water protection and leadership development.

We build opportunities for youth to develop leadership skills into all our activities because helping young people find their place in the world is an important element in building sustainable communities.

Donate to Windfall Centre

We take pride in the high quality of the programs and services offered to our community. It takes a dedicated group of staff, volunteers, and generous supporters from all walks of life to support our work in building a welcoming future for our children. Please become a donor today: www.windfallcentre.ca/donate

Executive Summary

Nations and local governments have already begun to recognize the importance of shifting humanity's approach to the environment. As part of this worldwide movement, Ontario has become a global leader in taking initiative to improve the lives of residents now and in the near and distant future.

However, it needs to do more to affect change on a larger scale. If Ontario wants to meet its target of reducing Greenhouse Gas (GHG) Emissions 15% by 2020 and 80% by 2050, the province is going to have to introduce innovative policies, integrate strategic measures to reduce emissions and work with stakeholders to develop a comprehensive strategy. Otherwise, it's likely to be met with failure.

While Ontario has reached its 6% goal for 2014, the most recent Greenhouse Gas Progress Report says the province will fall 28 Mt short in 2020, making it almost impossible to reach the 80% reduction target in 2050. For success, change is imperative.

This report is the first in a series that examines the economic and labour market impact of achieving Ontario's emission reduction targets. We begin with personal transportation because total emissions in the sector are growing at an alarming rate while solutions are tantalizingly within reach.

The demand for Electric Vehicles (EVs) as a passenger vehicle and also as a fleet vehicle has been on the rise, and the EV industry has made significant leaps in the last few years and will likely command a major share of the industry. Ontario is ideally positioned to be a leader in Electric Vehicle (EV) manufacturing, research and development. Exploiting its strengths in order to carve a niche in the EV industry would boost Ontario's productivity, with potential economic benefits not just for the direct participants in the EV industry but for all of Ontario.

The development of Plug-in Electric Vehicles sustains many economic, environmental and technological gains in the production of electric vehicles, their operation and construction of the supporting infrastructure. Electric vehicles are shown to realize large energy savings and realize many industrial gains but may also cause some disruptions and substitutions in the economy. The net effects, however, are almost all positive. In particular the study demonstrates the following:

- Large energy savings, particularly in those expensive and non-renewable fossil fuels imported from outside Ontario.

- Reductions in CO2 emissions and the prospect of placing Ontario as a frontrunner in the fight to eliminate CO2 emissions.

- Developing a new and dynamically growing industry with a capacity to generate sizeable employment opportunities at the upper end of the wage scale.

- Developing a new infrastructure of charging stations.

- Limited additional electricity generation capacity and delivery systems are needed when the projected shares of EVs are less than 10% of the Ontario fleet of vehicles.

- The phasing out of an old industry and the development of a new industry requires more but manageable numbers of graduates from Universities.

- The estimation of net benefits with a special focus on disruptions, substitutions and changes in the product and factor markets in Ontario all show positive returns and feasible proportions.

The major gains are expected to be in the manufacturing sector but substantial gains can be realized in the energy and infrastructure development sectors. Ontario manufacturing has sustained major losses recently as the Canadian dollar appreciated and provincial productivity declined. Imports of expensive energy, particularly of gasoline, exacted a heavy cost on the economy in step with escalating oil prices. The development and use of electric vehicles holds the promise to save Ontarians considerable amounts of money as cheaper electricity is substituted for the expensive imported gasoline and as a new manufacturing node is developed to shore up the sagging auto sector.

Table of Contents

About Windfall Centre

Donate to Windfall Centre

Executive Summary

A. Introduction

- Emission Reduction & Labour Markets

- Road Transportation

- Research Methodology

- Literature Review

- Ontario Economic Impact Model

B. Background on Ontario

- State of Ontario's Economy

- Ontario's Manufacturing Sector: Industry Profile, Trends and Analysis

- Ontario's Automotive Manufacturing Sector: Industry Profile, Trends and Analysis

- State of Ontario's Environment / Emissions

- Ontario's Road Transportation Sector

- Light Duty Gasoline Trucks and Light Duty Gasoline Vehicles: Trends and Analysis

- Ontario's Emission Targets Going Forward

- CAFE Standards

- Manufacturing and Operational Emissions: Electric vs. Gasoline Vehicles

- Ontario's Emission Intensity.

- Current State of Power Generation in Ontario

- Base load Generation: Nuclear and Hydro

- Peaking and Intermediate Generation: Hydroelectric and Natural Gas

- Variable Energy Generation: Wind and Solar

- Other Arrangements

- Transmission, Local Distribution Companies (LDC) and Planning Regions

- Ontario's Long Term Energy Plan

- Role of Conservation

- Nuclear Energy

- Renewable Energy

- Investments in Transmission

- Ontario's Planning Regions

- EVs and Ontario's Long Term Energy Plan

- Current EV Profile in Ontario

C. Potential Economic Impacts of EV Adoption in Ontario

- Introduction

- Methodology and Approach

- Gross and Net Impacts

- Shares of Electric Vehicles in Total Ontario Passenger Fleet

- Economic Impacts of Manufacturing Gasoline Vehicles

- The Economic Impacts of Manufacturing Electric Vehicles

- The Net Economic Impacts of Manufacturing Electric Vehicles

- Differential Operational Economic Impacts

- Economic Losses on Lower Gasoline Use

- The Economic Impacts of Increased Electricity Use

- The Economic Impacts of Net Savings on Fuel Use

- The Consolidated Economic Impacts of Operational Expenditures of EVs

- Differential Infrastructural Economic Impacts

- Determinants of Demand of EV Sales

- Economic Impacts of Surplus Baseload Generation

- Summary

D. Educational and Employment Requirements

- Introduction

- Projected Employment Growth Rates

- Categories of New Jobs in Demand

- Jobs Created by EV Manufacturing

- Jobs Created by EV Operations

- Jobs Created by EV Infrastructure Development

- Scientific Research

- Design and Development

- Manufacturing

- Maintenance

- Infrastructure Development

- Educational Requirements

- Training and Skill Gaps

- Labour Shortages

- Training

E. Getting To 80

- EV Adoption Scenarios

- Emission Reductions from EV Adoption

- Base Case: 5% Adoption

- EV Adoption as US Telephone

- EV Adoption as U.S Mobile Phone Adoption

F. Conclusion

G. Recommendations

- Recommendations for the Educational System

- Recommendations for the Provincial Government

- Recommendations for the EV Industry/ Employers

H. Appendices

Appendix A: Glossary of Terms

Appendix B: Partner and Contribution Acknowledgements

Appendix C: Assumptions

Appendix D: References

Appendix E: List of Tables and Figures

A. Introduction

Emission Reduction & Labour Markets

The Ontario provincial government through its' Go Green Action Plan On Climate Change sets targets to reduce Ontario's greenhouse gas emissions by 6% by 2014, 15% by 2020 and 80% by the year 2050, all below 1990 levels.[1] Part of this commitment involves transitioning the current mode of mobility towards the electrification of transportation, as personal transportation is one of the largest sources of GHG's contributing to climate change. Based on its commitment, the Ontario Government's ambiguous goal is to have 5% of new vehicles on the roads be electric by the year 2020, but has yet to establish specific sectoral emission targets, including the transportation sector.[2] Considering Ontario is home to 10 automotive assembly plants and 300+ independent parts manufacturers that employ over 90,000 people, transition from manufacturing traditional vehicles to electric vehicles is expected to create more opportunities across various occupations. This shift will create disruptive change throughout business supply chains, the oil and gas industry, energy production and storage and the electrical infrastructure sector. It is anticipated that employers and businesses will feel the effects of the transition to EVs as new jobs get created while existing jobs become reallocated, phased out or adapted with new skills. The advancement of public transit will also be a defining factor in reducing emissionsfrom the transportation sector, however this is not included as part of our analysis in this report.

The Ontario government supports the development of green jobs and a green economy, however, there is little published work to assess the full impact EV adoption will have on the current and future labour market in Ontario at this time. The industries we predict will be affected by this transition will require a highly-skilled and very knowledgeable workforce. However, the skilled trade workforce is aging and fewer young people are entering into apprenticeships and higher STEM education (Science, Technology, Engineering and Math). As electric mobility continues to grow, it is evident new skill gaps will emerge and a diversification of existing skills within the current labour market will be required to carry out the electrification of transportation initiatives.[3] As outlined in the Greening the Economy, Transitioning to New Careers, a study by the Workforce Planning Board of York Region et al., economic competitiveness and successful transition to a green economy at the regional and business levels is dependent on both a strong economic position and a skilled workforce. Consequently, employers will need to seek individuals who have the skills and knowledge required as Ontario moves towards the adoption of electric mobility.

Road Transportation

According to United Nations Intergovernmental Panel on Climate Change (IPCC), the road transportation sector consists of the following categories: light duty gasoline vehicles, light duty gasoline trucks, heavy duty gasoline vehicles, motorcycles, light duty diesel vehicles, light duty diesel trucks, heavy duty diesel vehicles, and propane & natural gas vehicles.

The personal transportation sector is a subset of the road transportation sector and consists of light duty gasoline vehicles (LDGVs) and light duty gasoline trucks (LDGTs). For the purpose of this report, and the scope of our research, we have focused only on Light Duty Gasoline Vehicles (LDGV) in the personal road transportation sector in Ontario.

For the scope of this report, we have focused on Electric Vehicles technology, which is defined as a Battery Electric Vehicles (BEV). We have excluded Plug-in Hybrid Electric Vehicles (PHEV) in our analysis.

Battery Electric Vehicles (BEV): Battery Electric Vehicles operate entirely on an electric motor powered by a battery. This battery is charged through an electrical outlet.

Plug-in Hybrid Electric Vehicle (PHEV): Plug-in hybrid electric vehicles have additional battery capacity and can be charged through an electric outlet when parked. Plug-in hybrids are able to travel in all-electric mode at higher speeds and for extended distances without using the combustion engine.

Electric Vehicles (EVs): As used throughout the report EV refers the BEV definition.

Research Methodology

Windfall Centre researchers conducted both primary and secondary research for this report. An advisory panel was formed with participants from various sectors relevant to the project and were chosen based on their expertise and experience. The advisory panel members, along with other individuals, participated in email and telephone surveys in order to gain an in-depth understanding of the various sectors relevant to the labour market and economic impact study of EV adoption in Ontario. Secondary research was also conducted by collecting, organizing and analyzing data sets and reports from various public sources, such as Statistics Canada, Electric Mobility Canada (EMC) and Ontario Power Authority (OPA). Windfall Centre also purchased additional industry reports from Electricity and Human Resources Canada and Navigant Consulting to supplement any research and information gaps. Windfall Ecology Centre engaged Econometric Research Limited (ERL) to conduct an economic impact analysis and create a model to identify and quantify the economic and labour market impacts of EV adoption in Ontario. Internal research pertaining to the state of Ontario's economy, labour markets, various emissions and economic indicators was conducted by Windfall Centre researchers.

Literature Review

There is limited research on the economic and labour market impacts of EV and electric mobility adoption. It is important to understand the potential implications of adopting a new technology and transforming our personal modes of transportation. This section discusses the seven main economic impact studies that were used to create an analysis of the effects of electric vehicle adoption and the electric vehicle industry in European Union (EU) countries, Austria, and in the United States (U.S.), particularly in Oregon and California and the greater Cleveland, Ohio area. The section discusses the methodology, the assumptions, various scenarios and the economic impacts on the aforementioned regions.

Douglas S. Meade published one of the first economic impact studies of relevance to the EV industry in 1995. The impact of electric car on the U.S economy: 1998 to 2005 uses the INFORUM LIFT macroeconomic inter-industry model of the U.S. to analyze the industry and the impacts of the structural change in the motor vehicle industry. The EV penetration rate, which is the share of EVs out of total vehicles, is set at 3.6 % by 2005 in all of the US. The results of the study show that macroeconomic effects are minimal but impacts on particular industries are significant given the small level of market penetration.

The INFORUM LIFT model is an inter-industry model that forecasts results for 85 industries in the U.S. The model tracks not only macroeconomic effects but also industry output and employment, and interdependence among industries. This study highlights the compositional differences between EVs and internal combustions engines vehicles (LDGV vehicles). Most input requirements of EVs are similar to those of LDGVs, however, there are certain components absent from composition. Electric Vehicles are made of an aluminum chassis, plastic and composite body parts, less ferrous metals, and more plastics and non-ferrous metals and copper, increased use of miscellaneous electrical equipment, communications equipment and electronic components, and electrical industrial equipment1.

The results of the model show most employment and output gains are expected in the following industries: miscellaneous electrical equipment, communication equipment and electronic components, and especially electrical industrial equipment associated with battery production activities. All these gains are a result of an increase in demand of electric car inputs which are directly correlated with an increased demand in EV usage. The most significant impacts on a macroeconomic level were experienced in petroleum and electricity consumption. According to the model, drivers would spend an additional $326.2 million on electricity in 2003, $526 million in 2005, and save $877 million in petroleum consumption in 2003 and $1.295 Billion in 2005. However, expenditures on auto repair jumped to 371 million by 2003 due to increased costs of replacing batteries in the electric car compared to the standard maintenance of a typical gasoline car. Finally, investment in charging stations by electric utilities is up about $500 million by 2003. Under the model, no disruptive changes are expected as a result of the substitution of gasoline-powered vehicles for electric vehicles. Changes in various industry sectors are more noticeable than changes in overall U.S. economy. The output of crude petroleum and petroleum refining industries' decreased every year from 1998 to 2005, whereas the electric utilities industry's output increased. By 2000, changes in both direct demand and total demand in petroleum refining decreased, and change is attributed to indirect demand for petroleum refining, most likely by the demand arising from increased production in the electric utility activities. The change in indirect demand by the electric utility industry for petroleum refining is even higher in 2005 and for the utilities industry most change in demand is the result of change in direct demand. The motor vehicle industry experienced a reduction in output because electric cars require less inputs and the production of traditional motor vehicle inputs transitioned into production of EV inputs such as batteries and other electrical components.

In terms of employment, significant differences are experienced in more labour intensive industries. The largest employment gains were in electric lighting and wiring, automobile repairs, communication equipment, electric utilities, and electrical industrial apparatus and distribution equipment. The biggest employment loss was in motor vehicles, wholesale trade, crude petroleum, natural gas, and ferrous metals. Overall, there is a net gain of 21,000 jobs by 2003. The majority of job gains are a result of the additional resources required to produce and maintain electric cars and the analysis in this study suggests a higher initial purchase price in addition to significant costs of battery replacement as each car ages. Therefore, the increase in employment is similar to that caused by a reduction in productivity. Directly and indirectly, it requires more labor services to produce an electric car than a conventional gasoline car.

Although many assumptions made in this study could be criticized, it provides a qualitative insight into what industries could be affected, the direction of this effect and some indication of the magnitude of changes. In reality, the actual penetration rates could differ, electricity consumption of an EV fleet could be higher or lower and production activities, though similar, could differ from one region to another, and many other scenarios not incorporated in the study could affect the EV industry. However, the study gives a good indication that results are more important for individual industries and these impacts could be much larger if the penetration rates were higher.

The University of Maryland and Keybridge Research LLC conducted a much more detailed analysis of the impacts on the U.S. economy as a result of policies designed to encourage the uptake of EVs. Released in 2010, Economic Impact of Electrification Roadmap looks at transitioning fuel based light duty vehicle fleets to electricity and what the impacts would be on the national economy. The study analyzes the economic impacts of policy directives articulated in Electricity Coalition's (EC) 2009 report Electrification Roadmap. The analytical exercise conducted for this project utilized a highly respected Inforum LIFT model, a general equilibrium econometric model of the US economy. The model determines changes in various economic indicators between base case and specific policy objective case by 2040. The analysis is conducted for the period between 2010 and 2030. The base case scenario incorporates an annual GDP growth rate of 2.5%, annual crude oil price growth of 3.2% with the crude oil price reaching $233 by 2030, approximately $149 per barrel in constant 2008 dollars. The policy objective for 2040 is to transform 75% of the passenger vehicle miles travelled in the US into electric miles. According to projections by the Department of Energy and the US automotive industry, the total number of miles travelled by light passenger vehicles would reach 4.2 trillion in 2040 and total electric miles travelled would need to reach 3.2 trillion in that year in order to accomplish the 75% electrification objective. The displacement of petroleum fueled vehicle miles travelled should result in reduced consumption of petroleum by light duty passenger vehicles that would result in a savings of 6 million barrels of oil per day.

In the base case scenario in 2010, EVs which include both PHEVs and BEVs have 0% share in sales and total stock but in the policy case, EV sale shares are 91.2% and EV stock share is 42.4% by 2030. Results based on the modeling exercise show that with the aforementioned sale and stock shares of EVs, total employment would increase by 1.9 million jobs. By 2030, there would be 560,000 more manufacturing jobs, 276,000 more jobs in travel and tourism, and 73,000 more jobs in professional services. Additionally, Employment in the motor vehicle industry (including motor vehicle parts) would be about 106,000 jobs higher than the base. Employment in the industries that supply key electric and electronic components to electric vehicles would increase by 112,000 jobs. The federal budget would also improve by a cumulative $336 million from 2010 to 2030, net of policy costs. Additionally, by 2030, US trade balance would also improve by about $127 billion dollars (2008 dollars).The budget improves as a result of higher levels of income and GDP from the policies mentioned in the Roadmap. The annual household income would by 2.2% per household, an increase of $1,763 (2008 dollars). Cumulatively households would experience an increase of $4.6 trillion (2008 dollars) in aggregate income from 2010 to 2030.

The analysis in this report also projects household savings. By 2030, a typical household in the U.S. would spend less per year directly on energy for transportation. This savings, coupled with higher income, means the typical household would be able to enjoy approximately $3,687 (2008 dollar) more in consumption of goods and services or personal savings by 2030.

U.S. crude oil and petroleum product imports would fall sharply by 3.2 million barrels per day by 2030. Cumulatively, the U.S. would import nearly 11.9 billion fewer barrels of foreign oil from 2010 to 2030. This compares to estimated reserves of 4.3 billion barrels for Prudhoe Bay, and slightly less than 30 billion barrels for total U.S. proved reserves. The very high adoption scenario significantly impacts world demand for oil. As the U.S. embraces electrification, world demand for oil would fall leading to lower world oil prices. The report also mentions that the price of oil would be almost 7% lower by 2030 than it would be without the Electricity Coalition's (EC) policy package, and that the U.S. economy will be stronger and more resilient. Once fully implemented, the EC policies would mitigate roughly one-third of the economic losses caused by a future oil price shock. By 2025, the EC policies would prevent the loss of 1.4 million jobs in the first year alone of a price shock-induced recession.

David Roland-Holst extends the economic impact analysis to the state of California. In the 2012 report Plug-in Electric Vehicle Deployment in California: An Economic Assessment, Roland-Host discusses the economic and environmental impacts of electric vehicle adoption through analysis for the State of California. A state of the art economic forecasting model was used to determine the linkages between various scenarios of plug in electric vehicle (PEV) deployment, economic growth, and job creation. The results of this study are similar to those articulated in the aforementioned economic impact studies and it reaffirms the positive economic impacts of electric vehicle adoption. The study finds that Light-duty vehicle electrification can be a potent catalyst for economic growth, contributing up to 100,000 additional jobs by 2030. On average a dollar saved at the gas pump and spent on other goods and services that households demand creates 16 times more jobs.

The study analyzed three scenarios: base line scenario, 15.4% PEV deployment in the new light duty vehicle fleet by 2030, and 45% PEV deployment for new light duty vehicle fleet by 2030. The long term aggregate economic effects of the two vehicle deployment scenarios indicate that new vehicle technologies, particularly those that reduce reliance on fossil fuels, stimulate economic growth and create jobs. The projections in the model also show that total employment grows in all sectors but it grows relatively slowly in fossil fuel-related sectors, and that the magnitude of economic impacts depends on the degree and scope of EV adoption. The resulting economic changes from PEV adoption are a consequence of a mechanism called expenditure shifting. Savings experienced by both households and enterprises as a result of reduced petroleum and diesel demand are spent on consumer goods and services. Consumption on goods and services tends to create more jobs per dollar of demand than the fossil fuel supply chain, and thereby creates substantial employment growth. Newly created jobs enhance the multiplier effect by leading to even more spending, consumption, additional employment, and thus enhancing the economic growth even further. Moreover, jobs created from the expenditure shifting are distributed across a broad spectrum of sectors and occupational categories, and not just restricted to green technology and import-driven energy fuels and services. Most of these jobs created by PEV adoption is in the service industry with high levels of instate inputs and value added. Such instate jobs have stronger and longer multiple linkages and are for the most part long term in nature, and less likely to be outsourced. Regardless of individual consumer decisions on whether to purchase a new car or not, Californians will always gain from economic growth associated with fuel cost savings. As a result of light-duty vehicle electrification, the average real wages and employment increase across the economy and incomes grow faster for low-income groups than for high-income groups.

Electric Power Research Institute (EPRI) extends its analysis to a much smaller region in its 2009 report Regional Economic Impacts of Electric Drive Vehicles and Technologies: Case Study of the Greater Cleveland Area. Looking at the regional economic impacts associated with large scale use of PHEVs and EDTs (electric drive technologies) in Cleveland, Ohio. EDTs include truck stop electrification, off-road industrial vehicles, alternative marine power, electric transport refrigeration units, on-road battery electric vehicles, and lawn & garden equipment. This study examines the regional effects as a result of petroleum displacement, increased electricity demand and annual fuel cost savings by consumers. The study applies regional input-output (RIO) analysis and quantifies macroeconomic impacts of transportation fuel switching, from gasoline to electricity, by assuming five different price scenarios and using two modeling approaches. RIO analysis tracks the economic impact from shifts in economic activity within a regional economy. It not only captures directs impacts such as those resulting from shift in household spending from gasoline to electricity but also indirect and induced impacts. Moreover, RIO methodology measures the shift in demand for all production inputs due to changes in demand for a final product: in the case of electricity production, inputs would be fuel purchases, equipment purchases, labour, and maintenance services.

In addition to quantifying effects of spending shifts, the study also analyzes the economic impacts of regional industry development related to electric market penetration in Cleveland. Both EDTs and PHEVs provide economic benefits by displacing expensive petroleum with cheaper electricity and therefore provide fuel cost savings to consumers. Petroleum expenditures tend to leave the region especially if it is imported. The cost savings from lower petroleum consumption tend to have a trickledown effect as these savings get absorbed and consumed by the regional and local economy. This economic effect is further enhanced by increased demand of electricity, which is cheaper to use than petroleum. The study further shows that higher PHEV and EDT usage not only lowers annual fuel bills, leaving consumers with more disposable income to spend on goods and services, but also nurtures growth and development of industries associated with electric drive technologies, including new vehicle production, battery manufacturing and recycling, infrastructure development, and research and development. Such levels of increased industrial activity and output require increased levels of labour, employment and income in the region. New earnings by both individuals and businesses culminate in additional spending on local goods and services, creating an economic multiplier effect throughout the region.

This study is particularly relevant because many regions in Ontario face a similar economic situation as Cleveland. In Ontario, many regions that once had a robust auto manufacturing sector are now faced with lower levels of output and employment, a situation very similar to Cleveland. The Ohio city has traditionally had a robust auto manufacturing sector but now faces various competitive challenges especially from overseas labour markets. The large scale development of PHEVs and EDTs and supporting industries is a potential path to compensate or recuperate for past losses to foster future gains in the manufacturing sector.

The research conducted in this study demonstrates that with petroleum prices at or above 2006 levels, significant economic benefits can be gained through the use of electric transportation technologies in the Cleveland region. Additionally, the study shows that focused and targeted development of support industries that facilitate the transition to electric transportation could generate tremendous economic benefits for the region. EPRI (2009) states that overall, the effects of a shift from petroleum to electricity in the transportation sector could potentially generate a net gain of tens of thousands of new jobs in the Cleveland area and increase regional economic output by billions of dollars annually.

Northwest Economic Research Center (NERC) takes a different approach in its analysis. Most of the studies discussed in this section analyze economic impacts of EV adoption, but NERC analyzes the economic impact of the entire EV cluster in its study. EVs in this study are defined as hybrid, plug in hybrid, all electric vehicles and a vehicle that uses a continuous supply of electricity, such as a street car. In its 2013 report Oregon's Electric Vehicle Industry NERC defines EV industry, identifies the EV cluster and determines and analyzes the economic impacts of the EV cluster in Oregon. There are no NAICS 2 designations or codes to track economic activity in the EV industry and most available data is mixed in with data from other industries making the isolation of EV relevant data particularly challenging. In order to isolate pertinent EV data and to better analyze relevant economic effects of the EV cluster in Oregon, NERC created a supply chain of raw material and parts/components suppliers, engineering and design firms, charging infrastructure manufacturers and installers, downstream activities that occur after the production of EVs, and ancillary organizations that support the core EV industry. Data was then collected through a survey filled out by various companies in the EV cluster and then this data was analyzed using IMPLAN, which is input-output software. Based on this analysis, NERC estimates that the economic activity from the Oregon EV industry, comprised of about 100 companies, creates 1,169 jobs, in addition to the 411 full-time jobs created directly for a total impact of 1,579 jobs. The industry generates gross economic activity of $266.56 million, total value added of nearly $148 million and provides over $89 million in total employee compensation.

Additionally, the industry generates a significant amount of tax revenue for the state and federal governments. NERC estimates total state and local tax revenue of $11.9 million and federal taxes of $20.8 million. Interestingly, Oregon's EV industry continued to grow during the recent recession while other transportation industries suffered enormous losses. In particular, the manufacturing, parts and components sectors enjoyed large growth during the recession.

In order to extend our review of the economic impact analysis to various global geographical locations, we have included studies on the European Union (EU) and Austria. Price Waterhouse Cooper (PWC) conducted economic impact analysis of Austria and presented its findings in its 2009 report The Impact of Electric Vehicles on Energy Industry. This report analyzes impacts of electric vehicles on Austria's total emissions, electricity generation, power grid, and national economy. The study analyzes data and information on passenger cars, two-wheeled vehicles (motor bikes, small mopeds, and mopeds) and light vehicles. This study takes into account purely battery electric vehicles only and is based on the assumption that 20% of passenger cars, light duty vehicles and two wheeled vehicles would be electric in 2020 and 2030.The level of electricity required for charging vehicle batteries was added to total daily electricity demand, and the assumption was made that vehicles would be charged in the evening or overnight. Vehicles would take 7 hours to charge at home and would be taken to a charging station during the day only when battery is completely empty. This study has determined that 20% coverage (approx. 1 million electric vehicles) would lead to a 3% increase in power consumption and would not require construction of further power plants. However, the power grid would have to be restructured to cope with additional demand when it occurs. The adjustments to the grid and the distribution network would be required where charging points would be located. Introducing electric vehicles to the Austrian market would require the installation of approx. 16,200 electric vehicle charging points. The analysis concludes that if electric vehicles are mainly introduced in cities, approx. 2,800 charging points would need to be installed. These installations plus network connections would require approximately $111 million Euros ($142 million Cdn) and $650 million Euros ($835 million Cdn), respectively.[4]

The study determines that 20% coverage could reduce total carbon emissions produced in Austria by 2 metric tons, which is a 16% reduction in carbon emissions caused by passenger cars, light duty vehicles and two-wheeled vehicles. Furthermore, 20% coverage would lead to an energy reduction of approx. 8.4 Terra Watt Hours (TWh), which would be approximately 37% of Austria's energy efficiency target for 2016. The economic impacts of 20% coverage are assessed in the form of cost-benefit calculations and comprise of impacts pertaining to tax deferrals, changes in oil imports, consumption changes as a result of changing demand requirements in electricity, petroleum and diesel, and investments in networks, charging stations, and electricity generation. Introduction of electric cars would result in reduced sales in petroleum, diesel and eventually reduced levels of crude oil imports. These reduced levels would lead to an increase in capital available to the national economy and more capital for investments especially in battery charging stations. Furthermore, the economy would experience surplus from additional electricity sales and additional power network usage, and a reduction in fuel tax revenues as demand for fuel decreases. The ability to resupply electricity with battery capacities not being used (through parked electric vehicles) would also result in a reduced need to expand power stations, thereby leading to reduced investment. The overall economic impact generally paints a positive picture, with the effect on the national budget being largely neutral (slightly negative in 2020 and slightly positive in 2030). The most positive effect will be felt by energy suppliers, which will hugely benefit through a positive net effect of up to around $1.3 billion Euros ($1.67 billion Cdn).[5]

Ricardo-AEA and Cambridge Econometrics (2013) discusses the economic impacts of adopting low carbon vehicles in the European Union. This study focuses on light duty vehicles: cars and vans. The results of this technical and macroeconomic study suggests a transition to low carbon technologies increases spending on vehicle technology, thus increases direct employment, and decreases expenditure on gasoline products, thereby creating indirect employment.

The first of a multi-phased approach examines the impact of improving vehicle efficiency by improving internal combustion engines through light weighting, engine-downsizing and hybridization. The second phase examines the impact of transitioning from fossil fuel energy resources to clean energy such as hydrogen and electricity. In the first scenario, cars and vans achieve the EU's proposed 2020 CO2 target of 95g/km and 147g/km, respectively, and efficiency improvements continue at about 1% per annum thereafter. In the second scenario, cars and vans achieve a slightly higher efficiency level in 2020 and continue along a similar trajectory of around 3% annual improvement thereafter. In the first scenario gasoline and diesel hybrids electric vehicles (HEV) are deployed at penetration rates of 10% in 2020, 22% in 2025 and 50% in 2030. The results show reduced spending on fuel more than outweighs the increased spending on vehicle technology to reduce carbon emissions.

According to the study, individual consumers spend about $1,000 to $1,100 euros more on a vehicle in 2020 due to additional vehicle technology than the average car manufactured in 2010. However, this additional cost would be offset by annual savings of around $400 Euros on fuel. On an EU level, the total capital costs of additional vehicle technology would be approximately $472 billion Euros in 2030, which is about $46 billion Euros more than the base scenario. However, this additional expenditure would be offset by avoided fuel costs of $79 billion Euros, and the cost of operating and renewing the EU car fleet in 2030 would be about $33 billion Euros less than in the reference case. These efficiency improvements feed through the economy in two ways. First, there is direct benefit to GDP from reduced imports of fossil fuels because it improves the trade balance. Second, there are indirect benefits to households and businesses, as lower operating costs are passed on in the form of lower prices to consumers. These lower costs not only represent additional real incomes for consumers, but also savings for businesses.

The model used in this study shows that increased spending on vehicle technology leads to job creation in the manufacturing of fuel efficient automotive components and from a general boost to the economy as a result of decreased spending on imported oil. Although the overall combined effect on GDP is neutral in all scenarios, 413,000 net jobs are created in the highest case scenario. This is derived from the fact that most money spent on oil leaves the economy while most money spent on fuel-saving vehicle technology remains in Europe as revenue for technology suppliers and companies that supply fuel efficient technological components benefit from increased revenue due to increased demand of such products. The model also incorporates sectors that lose jobs such as refining, distribution and retail of fossil fuels. The positive impact on jobs and GDP was highest in sensitivity analyses with high international oil prices due to increased value of avoided fuel consumption.

These seven studies emphasize the importance of higher levels of EV adoption for regional economic growth. Displacement of petroleum products such as fuel in favour of electricity, investment in parts, components, and technologies that make up an EV and investments in an infrastructure network that supports EV uptake enhances economic growth in many ways. Money saved as a result of lower oil consumption is used for other productive activities such as increased consumption expenditure on goods and services, and capital investments that support the EV industry. Money that would have been spent on oil and other petroleum products is circulated in the domestic economy, creating wealth through the economic multiplier effect, where every dollar spent equals an additional dollar spent by some other member of society, creating an economic ripple effect. Furthermore, EV uptake creates a new industry that in itself is a source of job creation, additional incomes and higher regional GDP. Lastly, higher EV penetration in both new sales and total stock of light duty passenger vehicles is vital to reduce the regional carbon footprint.

Ontario Economic Impact Model

The impact model used in this exercise is a special application of Econometric Research's (ERL) generic Regional Impact Model (RIM). It is a unique model that captures the economic impact of expenditures at the local level (counties or economic regions), the provincial level (Ontario) and the national level. The model is based on a novel technology that integrates input-output analysis and location theory.

The RIM impact system comprises many modules. The most relevant for this project are the labour market and environmental modules. The labour market module generates employment by sector and occupation. The environmental module generates the direct and indirect environmental impacts of a large set of environmental indicators including emissions, waste, energy consumption and green GDP.

The economic impacts of automotive manufacturing are driven by the cost of the vehicle spread over the input shares in the input-output structure of Ontario for automotive gasoline cars and by the adjusted bill of materials of EVs where metal fabricated components are partly replaced by electrical and computer parts.

B. Background on Ontario

State of Ontario's Economy

Ontario is the largest contributor to national GDP, federal tax revenues, is Canada's largest province by population, and also its largest exporter. Since 1997, Ontario's economy has transitioned into more service-based than a goods' producing economy. The service sector now constitutes a larger share of the provincial GDP than the goods producing sector. Even though both goods producing and service producing sectors have grown from 1997 to 2012, the service sector has experienced a higher annual growth rate than the goods producing sector. Figure 1 shows the relative contributions to Ontario GDP and relative growth rates of the two sectors between 1997 and 2012. In addition to Ontario's transition to the services' sector, it has also experienced a significant decline in the total employment and output of its manufacturing sector. This downward trend in manufacturing GDP and manufacturing employment is worrisome because Ontario's manufacturing sector is responsible for 46% of all Canadian manufacturing output and 44% of all Canadian manufacturing jobs.[6]

Even though manufacturing is still a major component of the provincial GDP, its share has been decreasing, while other industries, such as the construction industry, have increased their provincial shares. Ontario's automotive manufacturing sector has experienced similar declining trends in both total output and total employment levels as the overall manufacturing sector during the same period.

Ontario's Manufacturing Sector: Industry Profile, Trends and Analysis

Ontario accounts for 46.1% of Canada's total manufacturing output and 44% of the country's total manufacturing employment.[7] Most of Ontario's manufacturing clusters are based in and around the City of Toronto, Peel, Waterloo, York, Durham, Essex, Halton, the City of Hamilton, Middlesex, Niagara and Simcoe counties or regions.[8] According to the Mowat Centre report Ontario Made: Rethinking Manufacturing in the 21st Century, the majority of Ontario's manufacturing firms are small-sized businesses with fewer than 50 employees. Approximately 13% of companies are in the medium size segment, employing between 50 and 500 people, and large companies that employ more than 500 employees, account for only 0.6 % of Ontario's manufacturing workforce.

Historically, Ontario has had a robust manufacturing sector and it still maintains a sizeable share of the provincial GDP even though its total share has decreased between 2008 and 2012. Ontario's manufacturing sector contributed 22% to the GDP in 2002; however, from 2009 to 2012 its provincial share was only 13%. Ontario produced $98 billion in manufacturing output in 2000 and since then its manufacturing GDP has decreased almost every year. Correspondingly, Ontario's total employment in manufacturing decreased by 33% from 1997 to 2012, a net job loss of 220,000 from 880,000 employees in 1997 to 660,000 employees in 2012. Figure 2 shows the downward trends in Ontario's manufacturing GDP, total employment and the manufacturing sector's share of the total provincial GDP.

Ontario's manufacturing predicament is similar to that of various other peer jurisdictions in the U.S. and Germany. Compared to these two nations Ontario exhibits the most substantial employment decreases. Between 2001 and 2011 Ontario experienced a 5.5% drop in manufacturing employment, while the U.S. and Germany dropped by 4.2% and 4.0%, respectively.[9] In terms of output, Ontario lags even further behind with an average annual decline of 5.1% between 2004 and 2009, whereas output remained relatively constant over the same period in the U.S. and Germany.

Ontario's sluggish progress in manufacturing can partly be attributed to the higher value of the Canadian dollar. A higher Canadian dollar or exchange rate, which is the value of the Canadian dollar in terms of a foreign currency, makes Canadian goods and services more expensive relative to other currency. Like any other good or service, the demand for Canadian dollars is determined by the interaction between the forces of supply and demand. A number of factors can increase the demand for the Canadian dollar, or decrease the demand for other foreign currency, therefore exerting pressure on the Canadian dollar and making it more expensive relative to other national currencies. There are a few factors that determine the Canadian exchange rate, and paramount of these is the performance of the Canadian economy. The national economy is one of the most important factors that determine the exchange rate of the Canadian dollar. A growing and strong Canadian economy makes investment in Canadian assets attractive because of the expectation of higher returns on these assets, increasing demand for the Canadian dollar and its exchange value in international markets. Other important determinants of the exchange rate include the strength of the US economy, the current account balance[10], world commodity prices, world economic growth, global stability, investment speculation and national political stability. Equally, if not more important are the differential interest rates (Canadian interest rates vs. world interest rates), unit labour costs that reflect differences in compensation and productivity between trading partners, and in the case of Canada, the relative price of oil, a major Canadian export.

These exchange rate determinants do not act in isolation of one another; they are intertwined and for the most part simultaneously impact exchange rates, so it is difficult to attribute the rise or fall in exchange rates to a single factor. Similarly, the rise in the Canadian dollar relative to the U.S. dollar is a complex phenomenon and cannot be attributed to just one or two factors. However, many economists and analysts have attributed the rise of the Canadian dollar in the past few years partly to global commodity prices such as oil. Additionally, Canada's political stability and steady economic growth in the last decade, especially in comparison to other industrialized countries during and in the aftermath of the global financial crisis in 2008, have increased the global demand of Canadian dollars and assets. Economic growth in emerging and frontier markets[11] like India, China and Brazil have increased demand for commodities, driving up their prices and exchange rates of countries which are net exporters of these commodities; countries like Canada and Australia. As a result of rising oil prices, Canada's oil exports have increased significantly and so has the value of the Canadian dollar relative to the U.S. dollar. Figure 3 shows the increasing value of the Canadian dollar is linked to the rise in crude oil prices since 2003.

A higher exchange rate with the U.S. makes Canada and its manufacturing sector less competitive. When the Canadian dollar becomes more expensive relative to the American dollar, foreign demand for Canada's goods and services decreases, and a depressed demand adversely impacts total employment and production in the manufacturing sector. Ontario's manufacturing sector has suffered as a result of the rising Canadian dollar as employment in the manufacturing sector has decreased by 33% between 1997 and 2012. Although the exchange rate is not the only determinant of competitiveness, it is an important factor. Ontario's total manufacturing output shows a similar downward trend; in 2002, it constituted 22% of the provincial GDP, but only about 13% from 2009 to 2012 and since the turn of the century, Ontario's manufacturing GDP has decreased every year on average.

Another important measure of competitiveness is unit labour cost (ULC), defined as workers nominal hourly compensation divided by their hourly productivity. ULC also takes into account the exchange rate in order to determine unit labour costs in a single currency. ULC's formula is as follows:

ULC = (Exchange Rate * workers hourly compensation in terms of their national currency) / Worker's hourly productivity.[12]

The formula above shows that a rise in the exchange rate and hourly compensation, and a decrease in hourly productivity will increase the ULC, whereas higher hourly productivity has the opposite effect. Figure 4 shows the upward swing in both Canada's ULC and Canadian exchange rate and the direct relationship between the two. Figure 5 shows that manufacturing productivity, a measure of output produced in an hour, for both U.S. and Canada in relation to Canadian exchange rate. Canadian productivity was higher than it was in the U.S. in the earlier part of this century but has been lower since 2002. Even though Canadian productivity has grown annually by an average of 1% from 2000 to 2011, U.S. productivity has increased by 6% annually for the same time period. Between 2002 and 2011, U.S. improved its productivity per hour by 56% whereas Canada's improvement was only 11%. Another determining factor in the ULC equation is the hourly wage compensation. Higher hourly wages increase ULC. From 2002 to 2011, average annual U.S. hourly compensation increase was just over 3% annually compared to 8% in Canada (in U.S. dollars). According to the US Bureau of Labour Statistics (BLS), the annual earnings in manufacturing adjusted for inflation rose by just 1.5% in Canada between 2002 and 2010, compared with 10.2% in the U.S.[13] The majority of the increase in Canada's manufacturing ULC can be attributed to exchange rates and lower productivity because the inflation-adjusted hourly wage compensation is less than that of the U.S.

Ontario's Automotive Manufacturing Sector: Industry Profile, Trends and Analysis

Automotive manufacturing is a significant part of Ontario's economy, producing light duty vehicles which includes cars, vans, pickup trucks, and heavy-duty vehicles such as trucks, transit buses, school buses, and military vehicles. Ontario also produces a wide range of parts, components and systems for these vehicles. The automotive industry in Ontario complements its manufacturing activities by maintaining a well-developed vehicle dealer network, a world class distribution system and services' provision component. Ontario is the single largest automotive jurisdiction in North America, producing one out of six cars built on the continent which employs 127,000 people directly, with an annual payroll of $8 billion. [14] Additionally, Ontario is home to 97% of Canada's automotive production, exports most of its production to the U.S., and supports about 400,000 jobs throughout the province.[15]

Ten of the world's largest automotive firms are in Ontario, including General Motors, Ford, Chrysler, Honda, and Toyota. Homegrown automotive parts' giants include Magna International, Linamar Corporation, ABC Group and the Woodbridge Group. Other notable foreign companies in the auto parts manufacturing sector include Aisin Seiki, Amino, Brose, Dana, Denso, Johnson Controls, Lear, Nemak and Wegu.[16] Over 400 companies make up Ontario's automotive sector and are located in about 60 communities in the regions of Waterloo, Durham, Windsor-Essex, and the South Western Ontario Marketing Alliance (SOMA), which includes the municipalities of Alymer, Ingersoll, Stratford, St. Thomas and Woodstock, and cities of London and Hamilton.[17] According to the Swiss Business Hub Canada, every vehicle assembly plant in Canada (10) is located in Ontario and 22% of North American vehicles (2.5 million vehicles) were produced in Ontario in 2012. Ontario's assembly plants are located in Cambridge, Woodstock, Alliston, Oshawa, Ingersoll, Brampton, Windsor and Oakville and employ approximately 43,000 employees.

Ontario's automotive manufacturing sector produced about $15.6 billion in 2012.[18] The automotive sector's GDP has been decreasing at 1% annually since 2002, and the total decrease has been about 13.5% from 2002 to 2012.[19] The automotive industry's total output decreased 33% in 2009 from 2008 in the aftermath of the 2008 financial crisis and the sectors' output decreased to $9.2 billion in 2009 from $13.6 billion in 2008. Since 2009, Ontario's automotive industry has recovered somewhat, expanding its output every year. Since Ontario exports 84% of its automotive output to the U.S, the well-being of the automotive sector is closely tied to the U.S. economy, and as the U.S. economy recovered after the recession, so did Ontario's automotive sector. Ontario increased its automotive exports by 70% from $27 Billion in 2009 to $46 billion in 2012. Even though the automotive sector has expanded since the crisis, and overall it seems to be doing reasonably well, it would be irresponsible to disregard the effects of higher unit labour costs, lower productivity and higher exchange rate on this sector. Both total employment and output have been decreasing over the last few years likely due to the aforementioned factors. The total number of employees in the automotive manufacturing sector has decreased about 13% from 1997 to 2012, an annual average decrease of approximately 1%.[20] The total transportation equipment manufacturing sector's GDP[21] decreased about 6% from 2002 to 2012.[22] It is also interesting to note that since 2009, the overall decline in both the total manufacturing and automotive manufacturing sector coincides with Ontario's lower employment rates than those of Canada for the first time since the 1980s. Figures 6 and 7 show the declining rates for both GDP and total employment in the overall manufacturing and automotive manufacturing sectors which have been coinciding with the rise in manufacturing unit labour cost and the exchange rate.

Ontario has lost some of its traditional competitive advantages. The rise of the Canadian dollar due in part to Canada's energy exports and higher global commodity prices has eroded Ontario's labour cost advantage. Lower productivity and higher unit labour costs compared to the U.S. have been detrimental to Ontario's manufacturing and exports. So has the emergence of Mexico as a serious competitor to the Canadian automotive manufacturing industry. Two new plants started automotive production in 2014, and global automakers invested about $12.5 billion in Mexico in 2010, compared to just $3.2 billion in Canada. Additionally, the hourly wage in Mexico is only $8 an hour and with additional foreign investment expected in the near future, various trade agreements, and new production plants to begin operation in the next few years, Mexico is poised to overtake Canada as the largest vehicle exporter to the U.S.[23] There have been many debates recently about the place of manufacturing in Ontario and Canada's economic policy as some commentators have labelled manufacturing a dying sector and according to some, efforts to revive manufacturing have been a waste of time and resources. However, no region can have sustainable economic growth without a robust manufacturing sector. A recent report by the Mowat Centre argues that manufacturing is a key driver of economic growth and prosperity and through its contribution to research and development (R&D), manufacturing is an important source of innovation. Furthermore, manufacturing has important backward and forward linkages to other sectors in the economy. For instance, the Centre for Spatial Economics determined a $1 billion increase in manufacturing exports would generate an additional $805 million in manufacturing GDP and create 7,779 new jobs in the sector. Through its linkages to other sectors, manufacturing would also generate an additional $1.01 billion in GDP and raise employment by 8,776 in all other sectors combined. Manufacturing is a crucial source of export revenues and in Ontario, four of the top five international exports in 2011 were from the manufacturing sector.

In Ontario, total hourly labor compensation in manufacturing has traditionally been higher than the average of all other sectors. Higher salaries further create fiscal and economic effects in regions and communities where people live and work, and all other adjoining areas. It's indisputable that the manufacturing sector has the most direct and an indirect effect on a region's economy and the only way to revitalize Ontario's manufacturing sector is by committing to increase productivity. Ontario may not be able to regain its labour costs advantage relative to the U.S. and other low cost jurisdictions especially in South East Asia or even Eastern Europe, but it can still compete globally by enhancing its other competitive advantages and increasing its productivity. Increases in productivity can be achieved only if both the public and private sectors in Ontario commit themselves to investments in machinery and equipment, and R&D. These investments should not only focus on the traditional manufacturing and automotive sector but on new emerging industries where Ontario can play a significant role and the Electric Vehicle (EV) industry is how Ontario can become one of the major players in North America. Ontario's focus on reducing its carbon footprint by committing itself to renewable energy development coupled with its strong automotive manufacturing industry makes it a great candidate to develop an EV manufacturing and R&D center. By doing this, it could enhance Ontario's position in the global manufacturing supply chain and once again establish the province as a manufacturing powerhouse in North America. The demand for EVs as a passenger vehicle and as a fleet vehicle has been on the rise as both consumers and governments have become environmentally conscious (Figure 24). Consumers are interested in EVs because operating an EV saves them money on gas, and governments are interested in curtailing their consumption and reliance on fossil fuels. Furthermore, the EV industry has made significant progress in the last few years in terms of battery advancement and improving mileage travelled, and if technology continues to improve, EVs will continue to increase their share of the auto industry. Consequently, the EV subsector could potentially be a growth sector that Ontario can stake its future on. Ontario is ideally positioned to be a leader in EV manufacturing, research and development. Exploiting its strengths in order to carve a niche in the EV industry would boost Ontario's productivity, with potential economic benefits not just for direct participants in the EV industry but for all of Ontario.

State of Ontario's Environment / Emissions

In 2011, Ontario contributed about 171 megatonnes of carbon dioxide equivalent (Mt), which is the second highest contribution of GHG emissions in Canada and almost 24% of the country's total GHG emissions for that year[24]. In an effort to reduce its emission, the Province of Ontario established three GHG reduction targets in 2007:

- 6% below 1990 levels by 2014 (to approximately 166 Mt)

- 15% below 1990 levels by 2020 (to approximately 150 Mt)

- 80% below 1990 levels by 2050 (to approximately 35 Mt)

Since Ontario set its emission targets in 2007, it has made considerable progress in reducing its carbon footprint. Ontario has successfully been able to reduce its GHG emission levels by 14.5 % from 2007 to 2011.[25] Ontario's total decrease in emissions from 1990 to 2011 has been around 3.4% but most of these reductions were the result of the closure of coal powered electricity generators. Since 2003, Ontario has been able to reduce its of coal-fired electricity generation from 25% to 0% in 2014[26]. Even though considerable success has been achieved through the closures of coal powered electricity generators, Ontario still faces several challenges if it wants to accomplish its emission objectives. One of Ontario's biggest challenges is curtailing emissions from the transportation sector, and more importantly from the road transportation sector, which constitutes the majority of emissions produced by the overall transportation sector in the province.[27]

Ontario's Road Transportation Sector:

The road transportation sector consists of the following categories: light duty gasoline vehicles, light duty gasoline trucks, heavy duty gasoline vehicles, motorcycles, light duty diesel vehicles, light duty diesel trucks, heavy duty diesel vehicles, and propane & natural gas vehicles. In 2011, the road transportation sector in Ontario emitted about 45Mt of GHGs which is about 26% of Ontario's total emissions for the year[28]. Overall, the road transportation sector experienced an increase in its emissions by 30% from 1990 to 2011. Both the transportation sector and its subsector, the road transportation sector, have increased their share of Ontario's total emissions from 1990 to 2011. Figure 9 shows Ontario's total emissions, emissions from transportation and road transportation sectors.

The biggest emission contributors in the road transportation sector are light duty gasoline vehicles (LDGV) and light duty gasoline trucks (LDGT). These two categories make up the personal transportation sector. In 2011, both LDGT and LDGV were responsible for a total of 31Mt of GHG emissions, which is almost 69% of Ontario's total road transportation emissions and 18% of Ontario's total GHG emission. Adoption of Electric Vehicles (EVs) in Ontario could be an important strategy in curbing road transportation emissions. According to the U.S. Department of Transportation, potential GHG reduction benefits per vehicle by 2030 could range from 8% to 30% for advanced conventional gasoline vehicles, 46% to 70% for plug-in hybrid electric vehicles (PHEVs), and 68% to 87% for battery electric vehicles (BEVs).[29] Since actual GHG reduction per vehicle and consequently reduction in total emissions in road transportation sector depends on electricity generation mix, the U.S. Department of Transportation assumes that the country can reduce its current average GHG intensity from 615 grams of CO2 per kWh to somewhere between 379 and 606 grams of CO2 per kWh by 2030. Since Canada's current average GHG emissions intensity of electricity generation mix (180 grams of CO2 per kWh)[30] is well below the U.S. GHG emissions intensity, emissions reduction potential from electric vehicles is even greater in Canada than in the U.S. Since Ontario's electricity generation mix is mostly composed of nuclear and hydro, EV adoption would be an important contributor in Ontario's total emission reduction.

Figure 10 below shows that road transportation's share of Ontario's total emissions increased from 20% in 1990 to 26% in 2011. In the personal transportation sector category; light duty gasoline vehicle emissions share decreased from almost 11% in 1990 to 9 % in 2011, whereas light duty gasoline trucks have increased their percentage contribution of total emissions from 4 % in 1990 to 9% in 2011, with an overall increase of 109% from 1990 to 2011.[31] It is important to understand these emission trends for both LDGT and LDGV in order to formulate and implement policies that encourage EV adoption. Understanding these emission trends and the underlying factors is important not only for EV adoption but also for overall growth of EV industry in Ontario; from R & D and manufacturing to supply and distribution.

Light Duty Gasoline Trucks and Light Duty Gasoline Vehicles: Trends and Analysis

The decrease in the emission share of light duty gasoline vehicles could be attributed to two factors: First, better combustion technology and higher emission standards; and second, to the lower percentage share of light duty gasoline vehicles. LDGTs make up a higher portion of total personal transportation stock: total of both personal vehicles and trucks. In 1990, the number of light duty gasoline trucks sold in Ontario was 1.16 million and in 2011 the sales of light duty gasoline trucks totaled almost 3 million, an increase of 156% at an annual rate of 5%.[32] In comparison, sales of light duty gasoline vehicles in Ontario have increased by only 12%, at an annual rate of approximately 1% from 1990 to 2011. These numbers demonstrate a transition away from vehicles and towards light trucks, a category which also includes vans, SUVs, and various other light trucks popular for personal transportation. Furthermore, an analysis of new sales of passenger vehicles and trucks shows that new sales of trucks surpassed sales of passenger vehicles in 2009[33]. Light duty gasoline trucks tend to be more carbon intensive than light duty gasoline vehicles, and the relatively higher number of light trucks leads to higher emissions.[34] Since 1990 the emissions per capita of LDGT have increased while the emissions per capita of LDGV have decreased for the same time period. Although light duty gasoline trucks exhibit higher emission levels in the long term they show favorable emission trends in the short term as light duty gasoline truck emissions decreased by 6 % from 2005 to 2011.

Figure 11 and 12 shows GHG emissions of light duty gasoline vehicles and light duty gasoline trucks in relation to total number of vehicles and trucks. Emissions from both light duty trucks and vehicles could be further reduced by better emission technologies, stringent regulations like the new CAFE standards, control of urban sprawl combined with smart urban development and incentivizing vehicle users to start buying EVs. Currently, there are few electric trucks to satisfy consumers with a penchant for light trucks, however, more light electric trucks will be on the market in the near future as the EV industry continues to evolve and as consumers continue their uptake of EVs.

Ontario's Emission Targets Going Forward

Emission indicators show favorable trends for Ontario. Since 2007, total GHG emissions and total GHG emissions per capita have decreased and have been less than that of Canada since 1990. Ontario's contribution to Canada's total GHG emissions has decreased in the last few years and the Province is committed to cleaner electricity generation through a favorable course to achieve its goal. Although Ontario has made significant progress in the last few years, a 2014 report by Ontario's Environmental Commissioner, Looking For Leadership the Cost of Climate Inaction, says Ontario should meet its 2014 GHG emissions commitment, however, will actual exceed its 2020 objective because of an upward trend in emissions, [35]exceeding its 2020 goal by 28Mt. Although Ontario's closure of coal generators was a very important initiative, the Province hasn't shown the necessary commitment to reduce emissions in all other relevant sectors. Unless Ontario introduces innovative policies, integrates various strategies and implements measures to reduce emissions from all other emitting sectors, Ontario may not be able to achieve its GHG emission goals.

CAFE Standards

In an attempt to make personal transportation vehicles more efficient, Canada established the Company Average Fuel Consumption (CAFC) targets in 1974. Initially these targets were voluntary for auto manufacturers, but in 2007 Canada implemented the Motor Vehicle Fuel Consumption Standards Act (MVFCSA) making these voluntary targets mandatory.[36] In 2010, the CAFC program was replaced by the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations in an attempt to reduce greenhouse gas emissions from the automotive sector. These regulations were finalized in October 2010 and limited GHG emissions on passenger cars and light duty trucks from 2011 to 2016.

In late 2012, Environment Canada proposed Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations for 2017 to 2025 in alignment with the United States Corporate Average Fuel Economy (CAFE) Standards.[37] The new standards, created in 2009 following an announcement by President Barack Obama, takes an aggressive approach to reducing fuel consumption and GHG emissions from light duty passenger vehicles and light duty trucks.

Manufacturers are forced to meet the CAFE required levels which are dependent on vehicle size and have taken several approaches to meet the new mandatory standards, or risk being fined for their lack of compliance. In an effort to meet these standards, automakers are making more fuel efficient engines, adopting hybrid and electric technologies and using more lightweight materials such as aluminum, titanium and advanced high-strength steel over the traditional steel and iron.

Below is the chart which outlines the CAFE Standards for each year from 2012 to 2025. What is interesting is the fuel economy standards for light duty trucks are not as aggressive as those for passenger cars. It could be argued that if automakers were forced to find and incorporate technology into these trucks to match the increase in fuel economy to that of passenger cars, trucks would be so expensive the average Ontarian could not afford them. Considering truck sales have grown to surpass light duty passenger vehicles in Canada, this would be bad for business for automakers that rely heavily on truck sales.

2017 to 2025 Model Year Light-Duty Vehicle GHG Emissions and CAFE Standards: Supplemental

Manufacturing and Operational Emissions: Electric vs. Gasoline Vehicles

Accounting for total emissions generated by gasoline vs. electric vehicles should include both the manufacturing and operational emissions. Indeed there will be major reductions in emissions associated with the use EVs instead of gasoline cars but the expansion of production of EVs generates new emissions that need to be compared to those of manufacturing gasoline vehicles. The issue is not simply to highlight the emission savings inherent in using electric vehicles in lieu of gasoline vehicles but to assess whether or not total emissions are reduced when manufacturing of vehicles and electricity generation are also included. Our report and the Getting To 80 Calculator Tool only review the emission from operating the vehicles.

Total emissions are generated by a complex set of activities. First, there are the direct reductions in emissions that are associated with the substitution of gasoline vehicles with EVs. Second, the generation of the additional electricity to operate EVs will generate new pollution depending on how this electricity is produced. For example, hydro generation emissions are significantly less than coal or natural gas based generation. Third, the manufacturing of new EVs adds to emissions and the elimination of gasoline cars' manufacturing will reduce emissions.

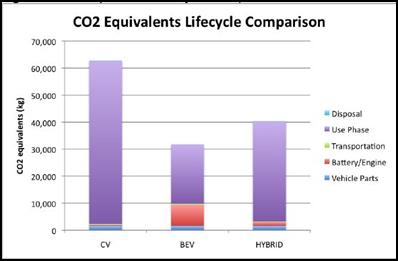

To assess the overall emission impacts of switching from ICEs to EVs, a full life cycle assessment needs to be conducted. There are several studies which have tackled this issue and the results are in favour of EVs. One such study was published by RICARDO-AEA, an international environmental and energy consulting company. Their analysis considered the lifecycle emissions for various technologies to provide estimates from the current situation in the UK out to 2050. They conducted a wide literature review and categorized the lifecycle into 5 main areas, vehicle manufacture, transport, operation, refuelling infrastructure and end of life disposal. The report investigated the influence of key geographical parameters on overall emissions, separated the emissions into UK and non-UK emissions, and explored the sensitivities for key components and scenarios on how these emissions might be reduced. What they found was that there were principal differences on how each stage was measured and the units of measurement used. For example, some areas which differed were the lifetime of the vehicle in kilometres and the assumptions used around the GHG intensity to manufacture EV batteries. [38] Overall, there was a consensus that EVs do produce slightly higher emissions during the manufacturing phase, but they do offer significantly less emissions during operations, offering around 77% to 89% emission reductions compared to ICEs in the year 2050.[39] The reason being is that the majority of emissions from the manufacturing phase are the result of making the batteries. This is anticipated to decrease over time as EVs increase in volume, battery manufacturing becomes more localized and battery energy density improves thus reducing the amount of materials needed.[40]

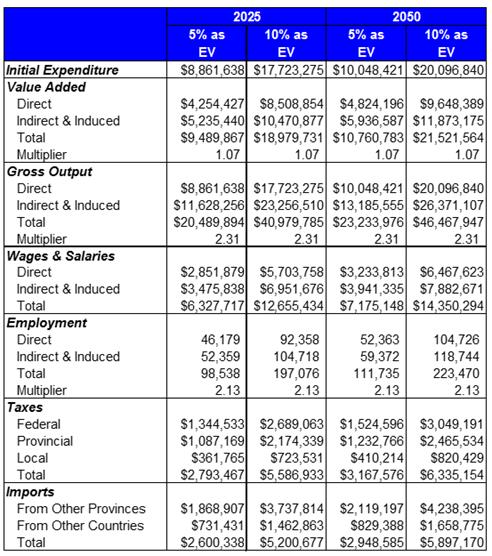

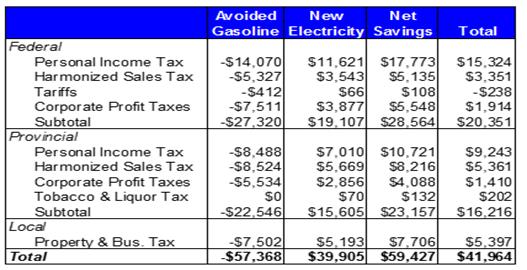

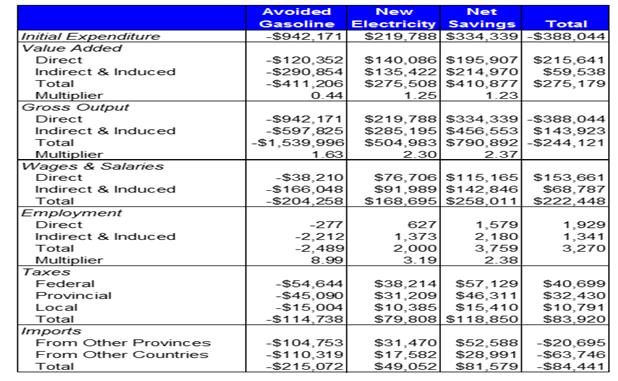

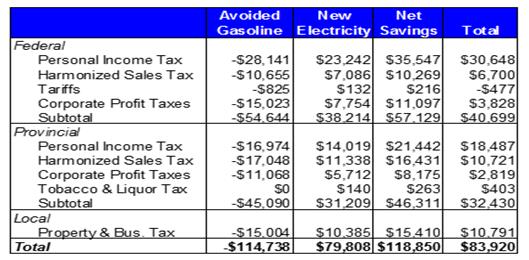

A California based research paper from the University of California, Los Angeles also highlights that the majority of the energy intensity in the lifecycle of a vehicle is a result of operating the vehicle, up to 95% of the lifecycle energy in an LDGV and 74% in a BEV over the vehicle lifetime.[41] This research paper also concurs that battery manufacturing contributes significantly to the lifetime energy requirements, at around 19% for a BEV, noting that vehicle parts manufacturing, transportation, and disposal are not significant to the overall lifecycle energy inputs of a BEV.[42] The figure above demonstrates the base case of emissions produced over the entire lifecycle of the vehicles (measured in CO2 equivalents), reveals that a CV (ICE) produces 62,866 kg CO2 equivalents, a BEV produces 31, 821 kg CO2 equivalents, and a hybrid produces 40,773 kg CO2 equivalents.[43] Overall they conclude that BEV have the least environmental impact, but do reiterate that the impacts from BEV rely heavily on the battery manufacturing electricity supply mix in the operating phase. Their sensitivity analysis of electricity mix dependency shows that California's electricity mix with 33% renewables, is the most energy efficient and the least polluting, resulting in an approximate decrease of 20% for both BEV emission and energy intensity.[44]